Developers of offshore wind projects in Japan are seeking to be included in a scheme that could guarantee fixed revenue for up to 20 years – a move that comes after Mitsubishi-led groups walked away from three projects due to soaring costs.

Japan’s long-term decarbonised capacity auction (LTDA) scheme currently allows bidding by operators of nuclear and gas power plants, hydropower and battery storage projects, as well as solar and onshore wind projects, but not offshore wind projects.

Yuichi Furukawa, wind energy policy director at Japan’s industry ministry, said offshore wind farm operators have made such requests but added that it could not say whether those requests will be taken into consideration.

Participation in LTDA “would be a life vest for the industry,” said an industry source involved in offshore wind policy discussions who declined to be identified.

Since the Mitsubishi-led (8058.T), opens new tab consortia in August dropped out from projects won in the country’s first large-scale state auctions in 2021, there has been much consternation about the fate of other projects in the works.

Other groups have won two subsequent auction rounds and those projects are slated to be launched between 2028 and 2030 with a combined capacity of nearly 3 gigawatts. The groups include Japanese companies JERA and Mitsui, as well as foreign firms such as Germany’s RWE, Spain’s Iberdrola, and BP.

The four groups that won the second round of state auctions for offshore wind projects are due to pay a final bond to the government, confirming they are proceeding with the development, in the next few months.

The government has promised to analyse the factors behind Mitsubishi’s decision and adjust regulations to ensure the sector’s development.

Even before Mitsubishi walked away, the government had sought to ease rules for the industry. Those changes include allowing changes in suppliers, including for turbines, and allowing offshore wind farms to operate beyond an original timeframe of 30 years.

Furukawa said the industry ministry aims to establish a framework by the end of this year to help companies make future operational decisions.

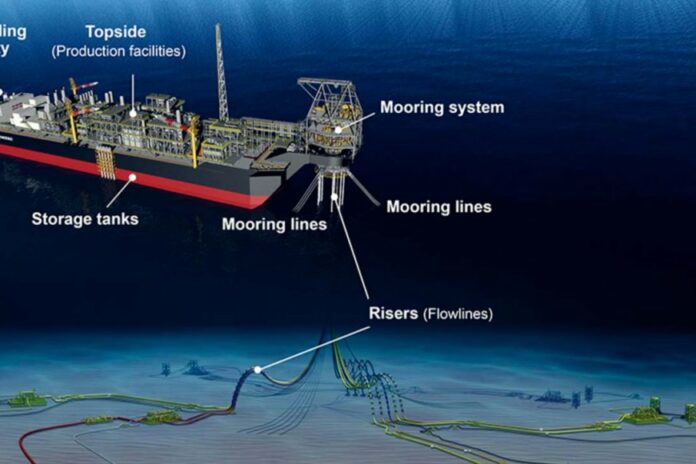

The government aims to have 45 GW of offshore wind capacity by 2040, which is seen as essential to cutting the country’s dependence on imported coal and gas for power generation, reducing its carbon emissions and bolstering national security.

“If the government takes the opportunity to reassess what went wrong, looking to and learning from other countries… the long-term (project) pipeline can remain robust,” said Hui Min Foong, a senior analyst at Westwood Global Energy Group.

“This is especially true looking further ahead 10 to 15 years from now, where Japan is well positioned to leverage its vast floating wind potential, reinforced by recent policy momentum.”

Source: Reuters