UNCTAD’s Review of Maritime Transport 2021 published on 18 November points to positive trends in maritime trade that might sustain economic growth in Africa, notably the entry into force of the African Continental Free Trade Area (AfCFTA) and the potential of technology to facilitate the continent’s trade and transport.

The AfCFTA agreement, under which trading started in January 2021, aims to increase intra-African trade by eliminating import duties – and to double this trade if non-tariff barriers are reduced. UNCTAD estimates that the agreement could boost intra-African trade by about 33% and cut Africa’s trade deficit by 51%.

The continental free trade area has significant implications for maritime transport and services trade. The report says:

“The AfCFTA is expected to increase demand for different modes of transport, including maritime transport, which in turn will increase investment requirements for infrastructure and equipment – ports and vessels in the case of maritime transport.”

It emphasizes the critical need to finance and develop adequate transport infrastructure and services in Africa to support maritime connectivity to fully realize the benefits of the AfCFTA.

A study by the UN Economic Commission for Africa with a time horizon of 2030 indicates that cargo transported by vessels would increase from 58 million to 132 million tons with the implementation of AfCFTA.

The study says Comoros, Gabon, Gambia, Ghana, Madagascar, Mauritius, Mozambique, Namibia and Somalia will experience a surge in traffic through their ports by 2030 as a result of AfCFTA.

If the necessary infrastructure projects are implemented, Africa’s maritime fleet is projected to increase by 188% for bulk and 180% for container cargoes.

The report also highlights the challenges that continue to weigh on the maritime sector, including the long port call times for vessels, significant liner shipping connectivity issues and drops in maritime volumes due to disruption caused by the COVID-19 pandemic.

Africa is expected to see some recovery in output and cargo imports, but it would be relatively moderate compared to other world regions. Africa’s maritime trade down in 2020 and lagging container port performance.

UNCTAD estimates Africa’s international maritime trade, including both goods loaded and discharged, to have fallen by 7.6% in 2020. While 2021 saw a revival in world cargo trade, the recovery was uneven, with exports from Africa and the Middle East remaining under pressure.

Africa’s contribution to global containerized trade remained relatively low in 2020, with container ports on the continent holding a 3.9% share of global container port traffic, compared to Asia with nearly two-thirds and Europe with 14.9%.

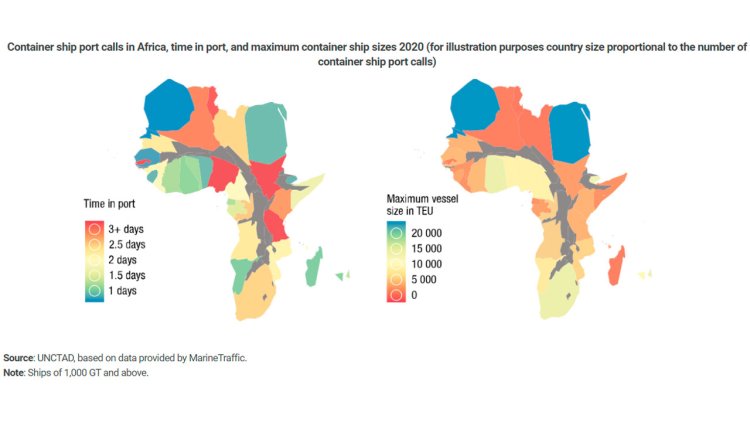

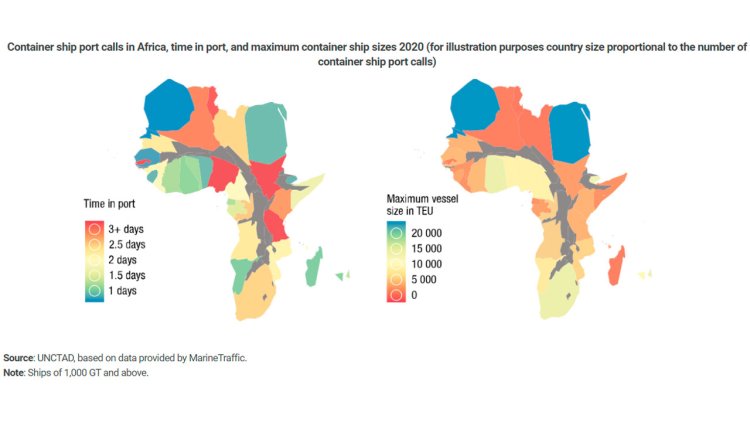

The report notes that the longest times in port for container ships are generally in Africa, notably in Nigeria, Sudan and Tanzania. Morocco is an exception, with one of the world’s shortest times for vessels in port. Tanger Med, Morocco, was also Africa’s best-connected port in 2020, the report states.

The report specifically analyses port performance and profitability based on members of the UNCTAD TrainForTrade Port Management programme port network, with results that demonstrate the challenges for Africa. For example, in 2020 average profitability for ports in the network declined by 12% in Europe, by 17% in Asia and by 25% in Africa. Latin America showed no change.