Bureau Veritas (BV), a world leader in testing, inspection, and certification, has delivered an Approval in Principle (AiP) to Hyundai Heavy Industries Co., Ltd (HHI) for its design and development of “Hi-Float”, a floating offshore wind turbine foundation.

The certificate was delivered to Seon Mook LIM, Executive Vice President of HHI, by Christophe CAPITANT, Chief Country Executive of BV Korea, at a ceremony hosted by HHI Offshore & Industrial Division in Ulsan, Republic of Korea.

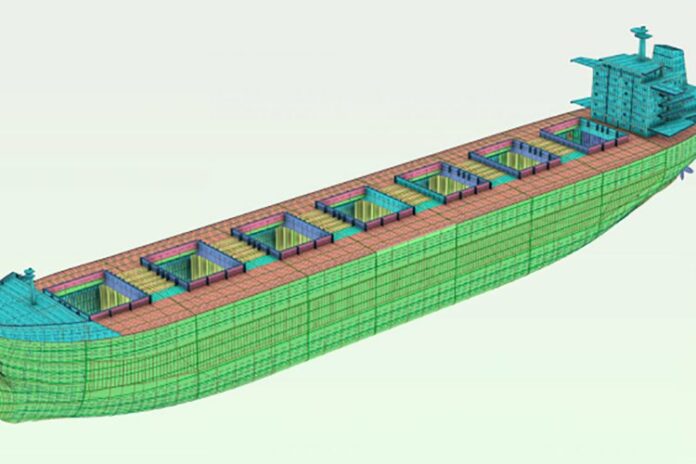

Based on HHI’s vast experience with offshore projects, the offshore floating wind substructure “Hi-Float” is designed to support a 10MW wind turbine with proven semi-submersible and mooring technology. A passive ballast system ensures that risk is kept to a minimum during offshore operations. The good performance of Hi-Float in offshore environment was verified through numerical analysis and wave basin model testing.

Seon Mook LIM, Executive Vice President of HHI, said:

“Obtaining the AiP for these innovative floating offshore wind turbine foundations is a meaningful technological milestone that will enable our solutions to contribute to the global decarbonisation effort. In addition, Hi-Float provides higher productivity considering the construction yard infrastructure and efficiency of marine operations. These projects are part of our continuous endeavors and commitment to a sustainable future that is aligned with HHI Group’s ESG vision, “Beyond Blue Forward to Green”. We also promise that HHI Group will encourage new value creation to lead the market, responding to customers’ desire for the achievement of net zero emissions”.

Alex GREGG-SMITH, Executive Vice President for Bureau Veritas Marine & Offshore, commented:

“This announcement demonstrates the importance of this technology, which will enable the development of future clean energy with zero carbon emissions, while managing risks of floating offshore wind farm development with efficient and safe operation of large scale wind turbines. We are also confident that our cooperation on technology development will lead to further successes to both HHI and BV within the developing renewable energy and floating offshore wind technology sectors, which will play a major role in the fight against climate change.”

There has been an increase in the number of floating wind projects emerging worldwide. Market projections show that, as new regional markets emerge, offshore wind growth will continue apace and it is also going to diversify. While to date the majority of offshore wind installations are bottom-fixed, in the coming decades the industry will witness an increase in floating wind capacity. While many technologies are still under development, floating wind has the potential to complement bottom-fixed technologies by enabling feasibility and competitiveness in deep water zones.

Currently, however, the share of floating installations in the offshore wind market remains limited. In 2019, out of Europe’s total offshore wind capacity of 22 GW, the largest regional capacity worldwide, floating wind still only represented 0.2% (45 MW) compared to bottom-fixed installations.

Since 2016, Asia has represented an increasing share of the offshore wind market. While wind turbine technologies have now had time to mature, the floating foundations that provide the base for floating offshore wind turbines are still going through stages of development. Coupling wind turbines’ aerodynamic loads with floaters’ hydrodynamic ocean loads also represents a complex challenge. To address this, it is not only necessary to apply lessons learned from the offshore wind and oil and gas sectors, but also to work with partners who can provide a holistic view of an floating offshore wind technology and project.