The consortium formed by BlueFloat Energy, Energy Estate and Elemental Group is announcing its plans for a multibillion-dollar investment in offshore wind projects in South Auckland and West Waikato, Aotearoa. The South Auckland-Waikato offshore wind project is the second investment to be announced by the partnership in New Zealand as part of a nation-wide programme to develop up to 5GW of offshore wind.

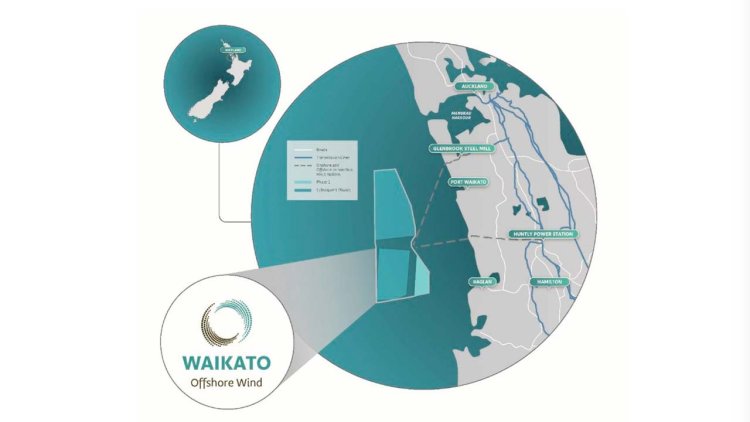

The project, currently named Waikato Offshore Wind project, is intended to be developed in phases to generate capacity of up to 1.4 GW of power using both fixed and floating foundation technology and capable of powering around 700,000 homes.

Phase 1 of the project is for a ~250 MW development using fixed bottom technology 22 kilometres off the West Waikato coast. The initial phase would create around 300 jobs in construction, operations and maintenance.

Options for Phase 2 utilise floating foundations and include the potential for an 800-1,150 MW development positioned to the west or north of Phase 1. Conservatively Phase 2 will create an additional 800 jobs with the potential for additional jobs dependent on the size of the project.

The consortium has completed its initial site selection and the project is now in the feasibility stage with construction expected to commence before 2030. The lifecycle of offshore wind farms is around 35-40 years at which point they would be decommissioned or re-furbished – providing decades of enduring employment opportunities and a secure supply of renewable generation to the Waikato and Auckland regions.

Carlos Martin, Chief Executive Officer of BlueFloat Energy, said:

“We believe that offshore wind energy can help achieve 600% renewable energy in Aotearoa creating security of supply for the country, meeting increased demands for electrification and decarbonisation.”

The partnership has been engaging with iwi and key stakeholders to determine the feasibility of offshore wind projects in New Zealand. The partnership is committed to honouring Te Tiriti o Waitangi and are engaging in ongoing discussions with iwi and hapū in South Auckland and Waikato about potential partnership models, including co-design.

Energy Estate Co-Founder Simon Currie said:

“We are committed to the development of the offshore wind energy sector in Aotearoa in a way that is inclusive and future facing and delivers enduring benefits to communities, regions and Aotearoa as a whole. We have a real opportunity to build the sector in a way where the offshore wind industry collaborates and doesn’t just compete. Our partnership wants to build an industry – not just projects.”

Offshore wind in the South Auckland-Waikato region will benefit from close proximity to the Huntly power station and the Glenbrook substation in South Auckland, next door to NZ Steel’s operations, offering a direct route to the grid and the potential to provide new supplies of clean energy to consumers and industry in the Waikato and greater Auckland area.

Local partners, Elemental Group, say the project offers significant opportunity for regional economic development in Waikato and South Auckland:

Elemental Director Nick Jackson said:

“An offshore wind energy industry will provide thousands of jobs for New Zealanders and require an entire local supply chain to support it throughout its lifetime. This is particularly true with floating wind developments which require significantly higher local content in manufacturing and services in addition to the expected operations and maintenance roles.”

Fiona Carrick, Chief Executive of Te Waka, Waikato’s Economic Development Agency commented:

“The energy sector is a key growth industry in the Waikato. The region is uniquely placed to become a national leader in renewable energy generation, and we are very pleased to welcome this project as another exciting development in the sector. As New Zealand, and the world, transition from fossil fuels, the Waikato region’s potential in geothermal, hydro-electric and wind power shapes up as a significant area of opportunity.”

Tātaki Auckland Unlimited Director of Investment and Industry Pam Ford commenting on the announcement said:

“With a new urban development equivalent to the size of Napier planned in southern Auckland for the next 30-years, we are excited for the offshore wind project and the opportunities this presents for sustainable business, investment and skilled employment opportunities in the area. We look forward to working with the consortium on making this project a reality, delivering enduring benefits to the community and a greener Aotearoa.”

Subject to further successful engagement with iwi and stakeholders and obtaining all necessary government and regulatory approvals the consortium hopes to see the first turbines in the water before the end of the decade.