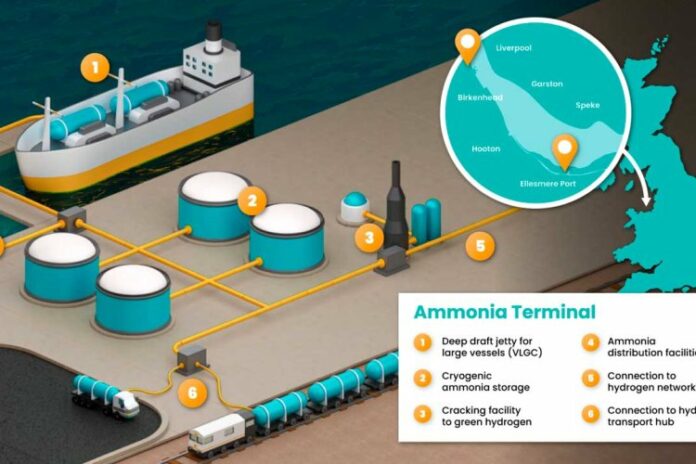

The new terminal, which will be an expansion of Stanlow Terminal’s existing facilities, will provide the connecting infrastructure to enable significant volumes of green ammonia to be imported into the UK.

Green ammonia is a highly effective liquid carrier of hydrogen, which allows for the safe and cost-efficient transport of green hydrogen at scale. The new terminal will enable the import and storage of more than one million tonnes per year of green ammonia for onwards distribution into the UK or conversion back to green hydrogen for supply to the North West’s industrial customers.

The green hydrogen produced will be used by a wide range of industries in the region, including as a sustainable fuel for marine shipping and to help decarbonise energy usage and, in doing so, contribute significantly to the UK’s net zero ambitions.

Green ammonia is a crucial component in the development of the global hydrogen economy and is expected to develop into one of the world’s major sustainable energy commodities. Once operational, the new terminal will put Stanlow Terminals at the heart of the global hydrogen energy market, with ready access to large scale international green ammonia imports. This can include imports from Essar Energy Transition’s own 1 GW green ammonia project in Gujarat, India.

The new terminal will be advantageously located within Stanlow Terminal’s existing facilities, where it will benefit from the Port of Liverpool’s unique combination of competitive geographical location, deep water access and maritime infrastructure which is capable of handling the largest gas carrier vessels. The terminal will also benefit from direct connectivity with Hynet, the UK’s leading low carbon hydrogen project in terms of scale and speed to market.

Feasibility studies are currently being undertaken, with the terminal currently scheduled to commence operations in 2027.

The development of the green ammonia terminal is the latest phase in Stanlow Terminal’s long-term plan to become the UK’s largest bulk liquid storage and energy infrastructure solutions provider.

Michael Gaynon, Chief Executive, Stanlow Terminals, commented:

“This new terminal is the latest milestone in Stanlow Terminal’s and Essar’s ongoing commitment to leading the UK’s low carbon transformation. By investing in new energies infrastructure and building a secure supply chain of green ammonia into the UK, we are building on our expertise in storing and blending of bulk liquids to put the North West economy at the forefront of the UK’s energy transition to net zero.”

Prashant Ruia, Director Essar Capital, said

“Essar Energy Transition is putting the UK at the forefront of the low carbon energy transition. We’re excited to be sharing more detail of our investment plans. The new terminal, provides the connecting infrastructure to enable Essar’ ambition to be a major hub of low carbon energy innovation and a leader in production globally.”

Claudio Veritiero, Chief Executive Officer of Peel Ports, said

“The Port of Liverpool is one of the world’s leading ports and we welcome Stanlow Terminals’ investment in its exciting future. Liverpool’s strategic location means it’s perfectly placed to support energy transition with exciting projects like this major new open access import terminal for green ammonia.”

Chris Shirling-Rooke, Chief Executive Officer of Mersey Maritime, said

“As the fastest growing maritime region in the UK, the Mersey is once again at the forefront of global maritime innovation. We welcome this announcement from Stanlow Terminals and welcome the commitment to support our environmental goals, and to see a positive impact on jobs and growth in our coastal communities.”