The ocean will play a key role in efforts to tackle the climate crisis, according to scientists and IPCC. The use of “negative emissions technologies” to enhance carbon sequestration and storage in the ocean is increasingly being discussed. In a study published in the journal Frontiers in Marine Science, RIFS researchers Lina Röschel and Barbara Neumann describe the challenges that these technologies present.

The existing regulatory and institutional frameworks are inadequate for the governance of these emerging technologies, they conclude. Instead, an approach is needed that integrates foresight mechanisms, considers the potential unintended impacts, and engages with diverse stakeholders.

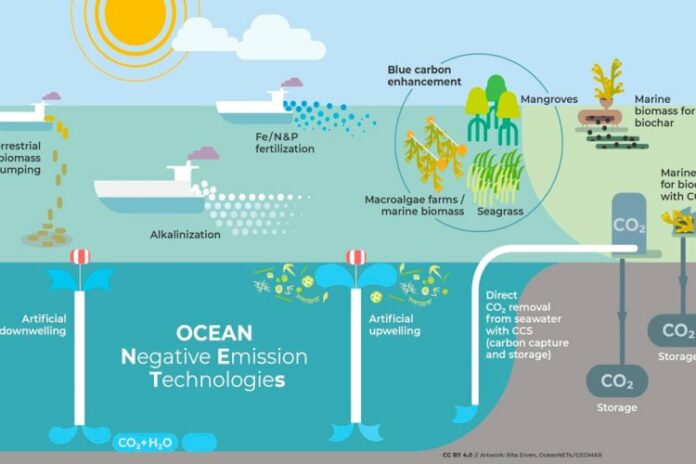

According to scientists, the ocean’s capacity to remove and store carbon dioxide from the atmosphere could be enhanced by various means, including the addition of alkaline substances such as olivine into the upper ocean, for example. This process, also known as alkalinization, harnesses chemical processes to alter the geochemistry of seawater and thereby increase the uptake of carbon dioxide from the atmosphere. Other potential methods rely on restoring or expanding coastal ecosystems such as mangrove forests, which can absorb and store carbon dioxide in underlying sediments.

In their study, which was conducted as part of the research project OceanNETs, the RIFS researchers offer an overview of the potential impacts of eight ocean-based negative emissions technologies on the marine environment and ecosystem services. Building on this, they analyze the existing governance framework and the demands that the deployment of these technologies would place on it.

The study also examines the potential unintended impacts of the selected technologies. Due to ocean currents, these could unfold far from initial deployment sites.

“This aspect must not be disregarded in decision-making processes. What is needed is a broader perspective that considers how the potential impacts of negative emissions technologies will interact with the objectives of existing agreements governing marine environmental protection, biodiversity conservation or even socio-economic issues relating to sustainable development—in addition to international agreements that explicitly address, promote, or restrict their use,” explains Lina Röschel.

The current international governance system, with its diverse agreements and regulations, institutions and responsibilities, is too fragmented to meet the complex requirements, according to Röschel.

According to the researchers, a foresight-oriented approach is needed in order to comprehensively and effectively regulate the use of these technologies in the future. “It is important that political, scientific, and societal actors engage with these issues today and develop approaches for the control and regulation of negative emission technologies—even if they are still under development in many cases, and their potential impacts cannot be precisely quantified,” says co-author Barbara Neumann, who argues that trade-offs should be minimized, and benefits maximized and distributed fairly across the globe.