The number of ships pulling into ports to unload and load containers rebounded in many parts of the world in the third quarter of 2020, according to new UNCTAD calculations.

This offers a hopeful sign for world merchandise trade, which suffered a historic year-on-year fall of 27% in the second quarter.

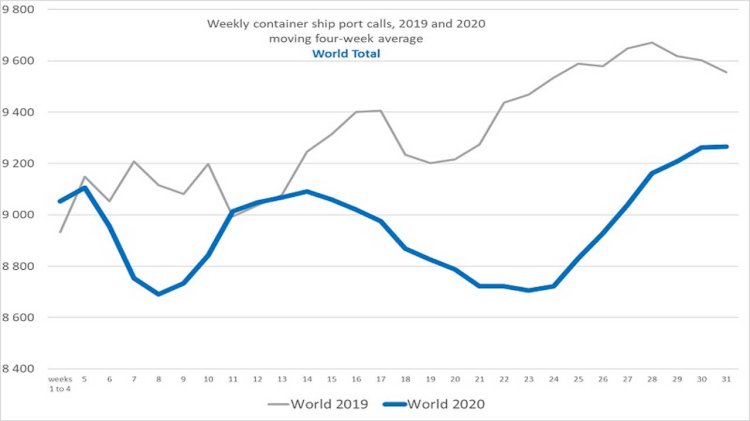

Maritime shipping saw a dramatic slowdown earlier this year as government measures used to curb the COVID-19 pandemic restricted economic activities and travel. By mid-June, the average number of container vessels arriving weekly at ports worldwide had sunk to 8,722, an 8.5% year-on-year drop.

But new data show that, globally, the average weekly calls have started to recover, rising to 9,265 by early August, just 3% below the levels of one year earlier.

Shamika N. Sirimanne, director of UNCTAD’s technology and logistics division, says:

“Most of the manufactured goods that we produce and consume are shipped in containers. The latest containership port call patterns therefore offer a ray of hope for economic recovery from the pandemic.”

A new UNCTAD article explores how data on the movement of vessels – which carry over 80% of the goods traded globally – can help policymakers navigate the troubled waters of a crisis while they wait for official statistics on trade and gross domestic product.

Figure: Weekly container ship port calls, world and selected regions

The UNCTAD article shows that, globally, container ship arrivals started to fall below 2019 levels around mid-March 2020 and then to recover gradually around the third week of June.

The start of the decline coincided with the World Health Organization’s decision on 11 March to classify COVID-19 as a pandemic, while the gradual recovery reflects the timeline when some countries began easing out of lockdown.

The UNCTAD article says that although most regions have seen some recovery in the third quarter of 2020, both in absolute numbers and compared to 2019 levels, the global figures hide important regional differences.

For example, while weekly container ship port calls in China and Hong Kong had climbed to 4.1% higher than the 2019 numbers by early August, calls in North America and Europe were still 16.3% and 13.2% below the levels registered one year earlier.

The diverging and volatile port call patterns across regions since June 2020 also underscore the fragility of the apparent recovery and the presence of factors that extend beyond the pandemic and lockdown restrictions.

Not all weekly changes in port calls are the result of the pandemic, UNCTAD says:

“Trade policy changes resulting in shifting trade patterns and regulatory measures that affect shipping and ports can also affect port calls.”

The article adds that the ship deployment strategies used by carriers as well as decisions by shipping alliances can influence port call choices as well.