The challenges are imposing. From much-reduced air and ocean cargo capacity and a rapid shift from in-store buying to e-commerce to the COVID-19 “bullwhip effect” on inventories and supplies, never have so many businesses and consumers had to adjust, improvise and innovate so rapidly. Here are four key logistics challenges that spurred the search for new solutions.

Capacity

Capacity evaporated. In normal times, ocean freight is typically around 90% of global trade volume. But the pandemic initially curtailed the supply of manufactured goods out of Asia, then rippled across the world and sent demand for goods shipped by ocean freight plummeting. Ocean carriers responded by removing shipping capacity from the market: cancelling sailings and eliminating “strings” where vessels call on several ports before reaching a final destination. Air freight capacity also dropped, in large part because a significant portion of air cargo flies in the bellies of passenger flights, many of which were cancelled as passenger traffic dried up. Meanwhile, driver shortages and cross-border restrictions shrank road freight capacity in certain places and led to long backups and delays.

Ocean freight capacity is starting to bottom out and stabilize. In the meantime, a number of other answers have emerged, including:

- Shift of ocean cargo to air, despite higher shipping rates and a scramble for space. Makers of tech products – laptops and headsets – saw demand soar as millions around the world left the office and began working from home for extended periods;

- Use of air charters for urgent, high-value cargo that would otherwise go aboard freighter aircraft or in the belly of widebody passenger flights;

- Conversion of empty passenger aircraft to “passenger-freighters” that can carry cargo in specially packed passenger cabins, in addition to belly cargo;

- Charter sharing and freight consolidation among forwarders or shippers that might normally be competitors;

- Alternative modes such as rail from China to Europe, then long-haul trucking across borders;

- Alternative airports, ports, and trucking routes where there is extra capacity.

Fluctuating demand

COVID-19 has turbocharged the consumer shift to online buying. In Italy, e-commerce sales of consumer products rose by 81% in a single week; McKinsey forecasts that 55% of consumers in China will continue shopping online as the crisis eases – for example, buying cars without ever visiting a showroom. Businesses weathering the storm include those with omni-channel inventory strategies that have pivoted to BOPIS (buy online, pick up in store) models, and smaller firms such as restaurants that transformed their websites into points-of-sale and converted themselves into delivery-led operations.

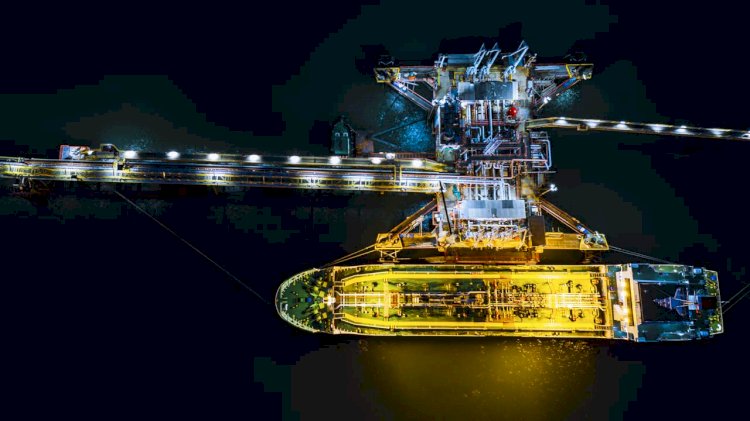

The retail-to-go approach presents logistics hurdles. E-commerce demands rapid fulfillment and delivery that is also inexpensive for the consumer. Among the solutions is alternative inventory storage: more warehousing close to point-of-origin or destination, conversion of stores into storage as distribution and fulfillment hubs, or strategic use of ocean freight as “floating storage” through careful timing of orders and deliveries.

Geographic risk

The crisis also provides an opportunity to re-evaluate supply chain locations. At the start of the pandemic, when China shuttered production, some US fashion retailers said more than 70% of their stock was sourced from the country. Disruption to its industries have left electronics retailers facing delays of 10 weeks on shipments. The same is true for brands producing in other nations.

Will the crisis alter global production and sourcing patterns? Will it prompt companies producing or sourcing in Asia to diversify by spreading production, or to adopt near-shoring or reshoring strategies? There are signs some US manufacturers are looking at bringing production closer to home, mainly in Mexico.

For many, it will be hard to cut or loosen ties to China. Supply chains there are highly efficient, the labor force large and skilled, the market vast and growing. Chinese production is deeply integrated with inputs from and production in other Asian markets. China, for instance, is a major source of fabric for garment manufacturers in the region, making it hard to remove from the equation altogether. And a “China+1” strategy to spread supply chain risk is also potentially expensive.

Many companies with the flexibility to move have already done so, as the result of US-China trade friction that began in 2016, or because labor costs in China were rising. Pre-COVID-19, the Agility Emerging Markets Logistics Index 2020 found 70% of those with operations in China were planning to stay put, despite global trade tensions and other headwinds. This sentiment may endure after the pandemic, suggesting a logistics-led solution, smoothing supply and demand issues, is the best approach.

Inventory management

Consider the COVID-19 “bullwhip effect” – the changes in consumer demand that ripple through the supply chain at ever greater magnitudes, creating long-term problems for production and supply. This can be seen in the one-off surges in demand for toilet paper – stockouts one week, then excess inventory buildup the next. From goods delayed to goods unwanted, the pandemic has created inventory chaos.

Some solutions exist in creative logistics:

- Improving visibility tools and using advanced data analytics for better modeling;

- Moving stock closer to key markets;

- Working out whether smaller volumes of inventory are needed in order to be more responsive to fast-paced trends;

- Demand planning and ordering in shortened, more frequent cycles.

One lesson of this crisis is that without people, technology is of little value. Companies that reacted quickly to the supply chain disruption caused by the pandemic typically did so because, as Biju Kewalram, Chief Digital Officer of Agility GIL, says:

“Technology doesn’t make itself useful. People make technology useful. We’ve found that the customers that have a high degree of digital supply chain already built in were able to flex a lot better and more quickly with us. But they also had agile organizations where internal collaboration and collaboration with customers and suppliers were already part of the culture, data and visibility were shared, and people were empowered to be nimble in how they responded.”

Source: Agility