The nearby spot rates for chartering large LNG carriers have been soaring at a time when future US export projects, fueling forward activity, continue to be given the “green-light”.

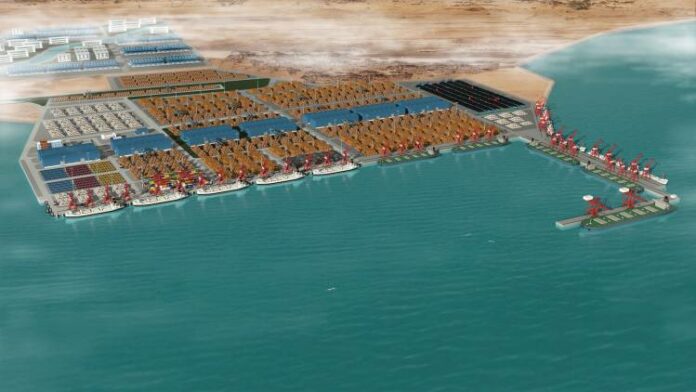

Recent reports from equity analysts, LNG has provided news that has featured prominently. Analysts at Cowen Securities have highlighted developments at Cheniere and Tellurian Cheniere, which has been a first mover among exporters, has been exporting cargo from Sabine Pass, on the Texas Louisiana border, since 2016, with its next facility, in Corpus Christi, set to come on line later this year.

The Cowen report highlighted regulatory approvals on Phase 3 at Corpus, which would come on stream in 2021, when Cheniere’s overall “nameplate” capacity- at Sabine and at Corpus, would exceed 20m metric tons annually.

Cowen notes that Tellurian’s Driftwood project, where molecules would be exported from a facility near Lake Charles, La, has seen a slight delay into early 2019, in obtaining a federal authorisation of its Environmental Impact Statement. They comment: “The approvals can still accommodate the company's goal for FID in 1H19 with operations commencing 2023.” If all the stars align, this project would be able to produce approximately 27m tons a year of LNG for export; the first phase would have the capacity for 11m tons a year of exports – if it goes according to plan.

While US exports, moving across the Atlantic and to the Pacific, through the Panama Canal, said to be increasing the number of allowed LNG transits, continue to attract attention, they are still a small component of seaborne LNG shipments. The growing spot component of LNG sales, from the US and also from traditional sources (with Qatar and Australia dominating) have brought more volatility to LNG charters.

Morgan Stanley’s Fotis Giannakoulis headlined his weekly Maritime Industries report with “LNG Tonnage Disappears as Global Prices Soar,” while Jefferies’ analyst Randy Giveans titled his report with “Atlantic LNG Shipping Rates Rise to $85,000 per day.”

Evercore ISI analyst Jonathan Chappell, a proponent of the sector even before the present run-up, offered the caption “Much More In Store than just a Seasonal Spike…Though that is Likely Coming too” on his publication. Chappell explained that: “Short-term rate volatility has been somewhat extreme over the last 12 months, with a meaningful winter spike late last year followed by typical seasonal weakening in the spring.” He added: “However, over the last few months short-term rates have strengthened materially, counter-seasonally, touching the highest levels since the last bull market of 2012.”

All shipping markets are caught in a tussle between available supply, and demand to move cargoes; clearly, the latter is driving the boat at this point in time. Morgan Stanley, in its report, suggested that: “Global LNG prices continue to climb driven by strong end-user demand and rising oil prices. October deliveries to Asia are now selling close to $12 pre mmbtu or +92% Year over year.”

In a similar vein, Jefferies explained that: “Charterers such as Cheniere, Chevron, and Uniper continue to lock in multi-month contracts ahead of the winter.” Evercore ISI’s analysis framed the chart for the coming months, with the present base “elevating the starting point for another anticipated winter market rally and the next cyclical upturn expected to begin in 2019 (but apparently already under way).”

Source:seawanderer