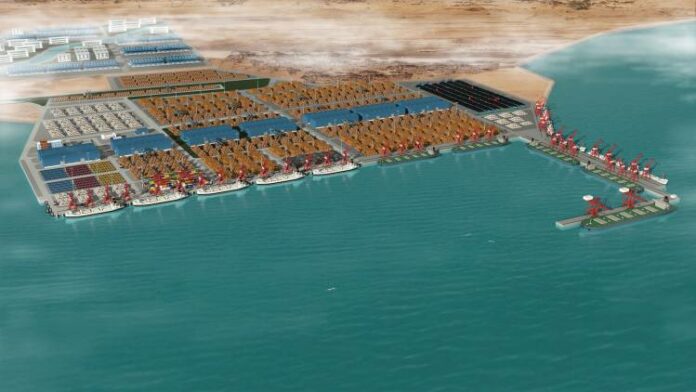

Dredging is a displacement of soil, carried out under water. It serves several different purposes. One of the applications meets the need to maintain minimum depths in canals and harbours by removing mud, sludge, gravel and rocks. Maintenance dredging is now only a basic task, while other fields are growing in demand much faster: creating new land for port and industrial development; trenching, backfilling and protection work for offshore pipelines, coastal outfall pipelines and for cables laid on the sea bed; environmental dredging and clean-up of contaminated sediments; replenishment of beaches and coastlines, not only for coastal protection, but also for recreational uses.

There are two methods of dredging: mechanical excavating and hydraulic excavating. Mechanical excavating is applied to cohesive soils. The dredged material is excavated and removed using mechanical means such as grabs, buckets, cutter heads or scoops. Hydraulic excavating is done with special water jests in cohesionless soils such as silt, sand and gravel. The dredged material which has been loosened from the sea-bed is sucked up and transported further as a mixture (solid material and water) using centrifugal pumps.

Mechanical dredgers

Backhoe dredger – A backhoe dredger is based on the giant land-based backhoe excavator that is mounted at one end of a spud-rigged pontoon. Its main advantage is its ability to dredge a wide range of materials, including debris and soft, weathered or fractured rocks.

Bucket chain dredger – Bucket chain dredge or bucket ladder dredge is a stationary dredger equipped with an endless chain of buckets carried by the ladder. The buckets are attached to a chain and graded according to size (200 to 1000 litres). Bucket dredgers are held in place by anchors. These days, this classic vessel is mainly used on environmental dredging projects.

The bucket chain dredger uses a continuous chain of buckets to scoop material from the bottom and raise it above water. The buckets are inverted as they pass over the top tumbler, causing their contents to be discharged by gravity onto chutes which convey the spoil into barges alongside. Positioning and movements are achieved by means of winches and anchors.

Cutter suction dredger – The cutter suction dredger is a stationary dredger equipped with a cutter head, which excavates the soil before it is sucked up by the flow of the dredge pump. During operation the cutter suction dredger moves around a spud pole by pulling and slacking on the two fore sideline wires. These dredgers are often used to dredge trenches for pipe lines and approach channels in hard soil. Seagoing cutter suction dredgers have their own propulsion. See also Cutter suction dredger d’ARTAGNAN.

Grab dredger – A grab dredger employs a grab mounted on cranes or crane beams. Dredged material is loaded into barges that operate independently. Grabs can manage both sludge and hard objects (blocks of stone, wrecks) and this makes them suitable for clearing up waters that are difficult to access (canals in cities), or for gravel winning and maintenance dredging on uneven beds.

Suction dredgers

Plain suction dredger – A plain suction dredger is a stationary dredger positioned on wires with at least one dredge pump connected to the suction pipe situated in a well in front of a pontoon. The dredged soil is discharged either by pipeline or by barges.

Trailing suction hopper dredger (TSHD) – The trailing suction hopper dredger is nonstationary dredger, which means that it is not anchored by wires or spud but it is dynamically positioned; the dredger uses its propulsion equipment to proceed over the track. It is a shipshaped vessel with hopper type cargo holds to store the slurry. At each side of the ship is a suction arm, which consists of a lower and a higher part, connected through cardanic joints. Trailing suction hopper dredgers are used for maintenance work (removal of deposits in approach channels) and dredging of trenches in softer soils.

TSHD has several special features, the main one being a drag arm which works as vacuum cleaner. Drag arm consists of a suction bend, lower and upper suction pipes connected via double cardan hinge and a draghead.

The suction bend is mounted in a trunnion which forms part of the sliding piece; as the pipe goes outboard the sliding piece enters the guide on the hull and is lowered until the bend is in line with the suction inlet below the waterline.

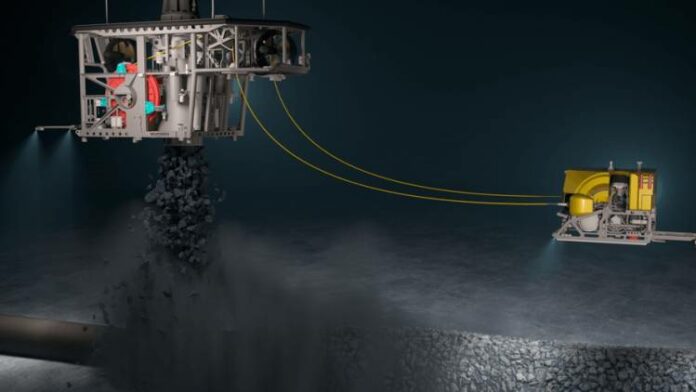

The suction pipe can be equipped with an integral submerged dredge pump. Submerged dredge pumps have become more and more popular with operators of larger trailing suction hopper dredges. Locating the dredge pump in the suction pipe positions is much closer to the seabed than a conventional dredge pump housed in the hull.

The drag arm is hoisted outboard and lowered to dredging depth with the aid of gantries. When not in use, it is lifted above the main deck level and pulled inboard with the hydraulically powered gantries for storage.

Discharge operations, discharge installations

When the vessel has to be discharged, jet pumps are used in the hopper to dilute the spoil so that it can be pumped ashore or discharged o the seabed through bottom doors. Occasionally, accurate placement of the material at great depths is possible via the suction pipes.

Fixed means of transporting dredged soil requires a floating pipeline from ship to shore, a powerful pump and a special link between pipeline and vessel – the bow coupling. Fixed and flexible models are in use. Fixed bow coupling has one degree of freedom (pitch), the flexible one has two degrees of freedom (pitch and turn). The flexible bow coupling can handle difficult sea conditions and reduces loads on the floating pipeline.

The mixture can also be jetted forward over the ship bow via a mixture jetting nozzle (rainbowing).