The Oda field is Spirit Energy’s first development as operator on the Norwegian Continental Shelf. When the Plan for Development and Operation (PDO) for the field was submitted to the authorities in November 2016, production start was scheduled for 1 August 2019 and total investment costs were estimated at 5.4* billion kroner (£485 million).

The most recent calculations indicate that the project will be delivered at a price of around 4.6* billion kroner (£413 million) – an improvement of nearly 15%. Important reasons for the cost cuts include efficient drilling of production wells and a new type of cooperation with suppliers.

“Norway is a key region for our business and we have now reached production start for our first development project as operator on the Norwegian Shelf, without serious incidents. When we are also well ahead of schedule and well below budget, there is every reason to be proud,” says managing director Rune Martinsen in Spirit Energy Norway AS.

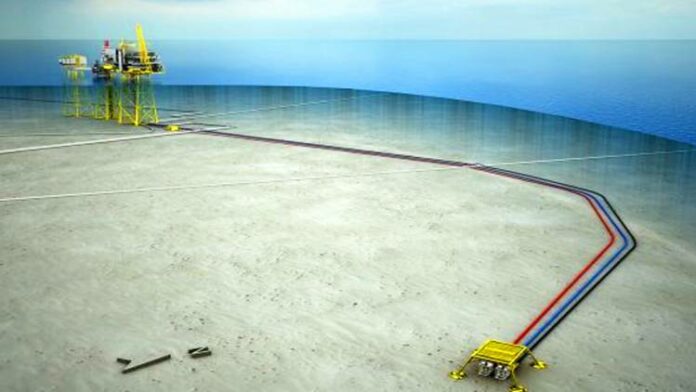

Prior to start-up of the Oda project, Spirit Energy entered into long-term contracts with four supplier companies; Aibel, Subsea 7, TechnipFMC and DNV GL.

The agreements were based on a new initiative on the Norwegian Shelf, and were signed for up to 10 years. The objective was to achieve long-term cooperation, as well as to create value and predictability.

Spirit Energy Norway is the operator for Oda, with an ownership interest of 40%. The partners are Suncor Energy Norge (30%), Faroe Petroleum (15%) and Aker BP (15%).